So, EVs are better for the planet. But what about fleet managers’ wallets?

By now, you probably know that fleets relying exclusively on internal combustion engine (ICE) vehicles are highly pollutant and could easily be replaced by a mix of electric vehicles and cargo bikes. If you don’t know this yet, read our previous article ‘How last-mile fleet electrification is driving opportunities’.

Fleet electrification is a must for all fleet managers, especially for those operating last-mile delivery fleets. The increase in regulatory pressure with the ban on the sale of ICE cars and vans by 2035 across Europe and the rise of low-emissions zone in the centre of major European cities, from Paris, London and Barcelona to Stockholm, not switching to electric would mean impacting your ability to operate across major part of Europe.

But do you know that fleet electrification is also good news for your bottom line?

At first glance, it may seem to be quite the opposite, with EV upfront costs traditionally higher than ICE vehicles. However, this is far from the reality. To truly understand the cost impact of switching to EV for your commercial fleet, you need to consider the Total Cost of Ownership (TCO) of your vehicles.

What is the Total Cost of Ownership (TCO) of a vehicle?

The Total Cost of Ownership (TCO) of a vehicle is a financial concept used to assess the complete cost of owning and operating a vehicle over its entire lifespan. It's a comprehensive approach to evaluating the financial implications of ownership. TCO takes into account not only the initial purchase cost but all the expenses incurred throughout the asset's ownership, maintenance, and eventual disposal.

The key components of TCO are:

the purchase price (capital cost): this is the upfront cost of acquiring the vehicle, which includes the base price, any additional options or features, and any associated fees (e.g., taxes, registration).

financing costs: If the vehicle is financed through a loan or credit, the interest on the loan and any financing charges are considered part of the TCO.

the operating costs: These include ongoing expenses such as fuel, maintenance, repairs, insurance, and taxes.

depreciation: it represents the decrease in the vehicle’s value over time. It's a crucial factor in TCO because it affects resale value, which impacts the overall cost of ownership.

resale value: The expected value of the asset when it is sold or disposed of at the end of its useful life is also taken into account. A higher resale value can reduce the TCO.

environmental costs: TCO may consider environmental costs, such as emissions or pollution control measures.

TCO is an important concept for fleet managers when making purchasing decisions. By calculating the TCO, you can make more informed choices based on a broader understanding of the true cost of owning and using a vehicle over time. It's particularly valuable when comparing different options, such as choosing between an ICE vehicle and an electric one, where factors like fuel costs, maintenance, and environmental impact can significantly influence the overall cost of ownership.

So, without further ado, let's jump into the comparison of Total Cost of Ownership (TCO) between ICE vehicles and EVs! And don't worry, this is the only sentence with so many acronyms.

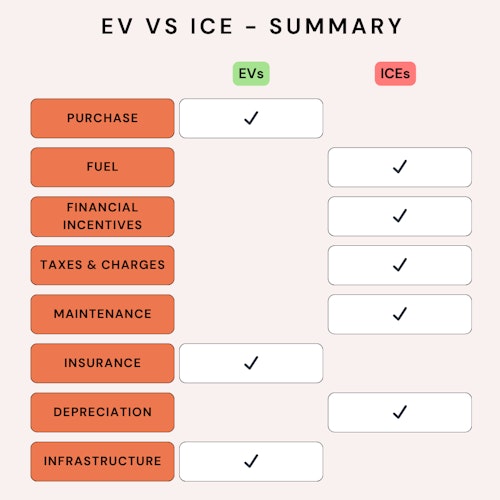

Purchase Price - Winner: ICE vehicles

This is probably the only cost for which ICE vehicles come up cheaper.

Electric vehicles often have substantially higher purchase or lease prices compared to traditional combustion engine vehicles, although, this can vary based on the make, model, and trim level.

As this constitutes the most apparent cost, these upfront costs associated with transitioning a commercial fleet to electric vehicles can be a barrier for some businesses.

However, with the majority of the less visible costs, EVs come in cheaper.

Fuel cost - Winner: EVs

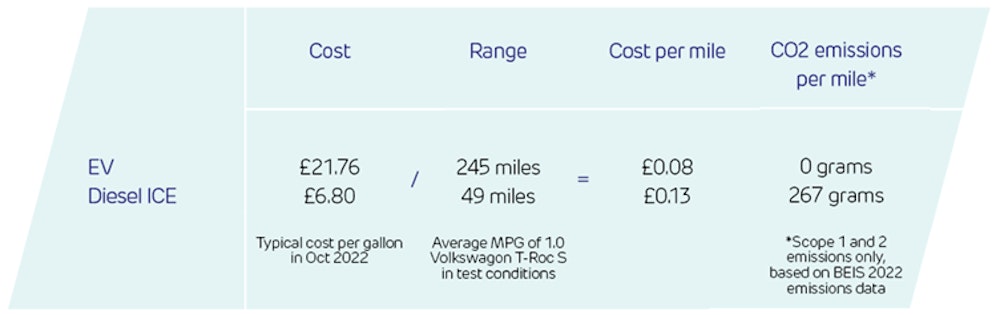

To calculate fuel expenses you’ll need to consider vehicles’ fuel efficiency, anticipated mileage, and local fuel prices. Electricity costs impact electric vehicles (EVs), while gas costs drive ICE vehicles’ fuel costs.

Typically, electric vehicles are more efficient than their ICE counterparts and despite the recent increase in the cost of electricity, it is still cheaper to run an EV than an ICE vehicle. The difference is even greater depending on the type of chargers used. For example, charging EVs on workplace, depot or home-based chargers would be cheaper to use than public chargers. How much you’ll save by vehicle will thus depend on your infrastructure and the mileage you are expecting your vehicle to drive.

Drax estimated that the cost per mile of an EV was approximately 38% cheaper than that of an ICE vehicle. This cost difference may vary depending on the type of ICE vehicle, but similar results have been found across multiple vehicle types.

Financial Incentives - Winner: EVs

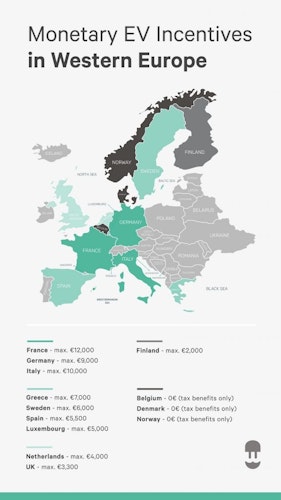

Across Europe, most of the financial mobility incentives have been redirected towards hybrid and electric vehicles to support the transition to net-zero in the transport sector. National incentives and benefits for EVs vary across the EU. 12 EU countries offer bonus payments or premiums to buyers of EVs, and most grant some kind of tax reduction or exemption for buyers and owners of EVs.

In the UK, fleet managers can benefit from up to £2,500 for small vans and £5,000 for large vans for the purchase of a vehicle emitting less than 50g of CO2 per km. Additionally, employers have to pay National Insurance contributions (NICs) on company cars when they allow drivers to use them for personal use as well as business purposes. However, a nil rate of tax currently applies to zero-emissions vans within Van Benefit Charge, which means that you could allow your electric van drivers unrestricted private use of their van as a tax-free employee benefit. Other EVs fall into a lower-rate NIC bracket than ICE vehicles. There are corporation tax benefits, too – businesses can claim the full purchase cost of EVs against profits. And, even if businesses lease EVs, they can claim back VAT against lease payments and maintenance costs.

Take the time to consult the incentives that apply to your specific case, based on your countries of operations and type of fleet. These incentives can provide substantial ways to make your transition to electric fleets even more worthwhile.

Taxes and charges - Winner: EVs

Many clean-air or low-emission zones has popped out in major cities across Europe, with different types of rules applying to each of them. Most of them imply either a pure ban of ICE vans within the zone or fees to be paid. While lots of ICE vehicles don’t meet the criteria for exemptions, EVs are exempt and can drive freely throughout these zones, with no fee to be paid. With many cities adopting this type of schemes, EVs offer significant cost savings, especially for fleets driving predominantly in urban areas.

For example, in London, the daily charge for the Ultra Low Emission Zone is £12.50 while the Congestion Charge is £15. This is £27.50 per day, per ICE vehicle that you could save!

Maintenance and Repairs - Winner: EVs

All vehicles require regular maintenance such as oil changes, tire replacements, and other routine services, on top of any unexpected repair costs that might arise over time.

EVs typically have less parts than their ICE counterparts. This means they tend to need less maintenance work. This results in lower servicing costs overall. The exceptions here are battery repairs or tyre replacements. In these cases, costly repairs and/or lengthy waits for parts can lead to extended off-the-road periods for EVs.

For the most part, however, EVs reduce the downtime that ICE fleets suffer from during regular maintenance works, thus limiting business costs due to lost income due to unavailability and to the extra cost of having to pay to temporarily replace vehicles.

Insurance - Winner: ICE vehicles

Insurance premiums can vary depending on the vehicle's make, model, and driving history but overall, they still tend to be more expensive for EVs. This is mostly due to batteries. They are expensive to produce – demand is high, but large-scale production is still at an early stage.

There have also been issues with the limited availability and associated costs of certain metals used to produce batteries. However, as the price of batteries continues to decrease and as more mechanics become familiar with electric vehicles, the cost of insuring an electric car is expected to continue to fall.

But, the gap is closing, and in some cases, insurance for EVs is becoming cheaper. This is mostly due to EVs being less likely to be stolen due to their limited range, charging options, and onboard tracking technology. Their lower centre of gravity, also means that they are less likely to roll in the event of a collision.

Depreciation and residual values - Winner: EVs

All vehicles experience depreciation over time, but a higher residual value can help offset higher purchase prices and significantly impact your fleet’s total cost of ownership (TCO). It is crucial to understand how much each of your vehicles will depreciate during your ownership period, considering their types, brands, and models, as resale values and depreciation rates can vary greatly.

When it comes to depreciation, electric vehicles tend to perform better compared to petrol cars, which usually depreciate the fastest. Diesel vehicles have also experienced faster depreciation in recent years, partially attributed to the diesel emissions scandal.

Initially, electric vehicles (EVs) had poor residual values due to the limited size of the second-hand EV market. However, with the increased demand for used EVs, they are now retaining their value much better, especially for vehicles with batteries still under warranty.

Furthermore, with the European Union planning to ban the sale of new petrol and diesel vehicles in 2035, the days are numbered for internal combustion engine (ICE) vehicles, and vehicle buyers are becoming increasingly aware of this shift.

The variables for which there is a tie.

While some factors mentioned earlier have a clear winner, determining the exact cost difference that electric vehicles (EVs) would make to your fleet operations is more difficult for others. These factors include financing costs, driving style, changing electricity and fuel prices (although charging EVs is likely to remain cheaper than fueling internal combustion engines), distance travelled, expenses at public charging facilities (if used), and labor costs for maintenance and repairs. Another variable to consider is whether you decide to include charging infrastructure costs in your total cost of ownership (TCO).

For all these variables, you’ll need to consider your current fleet’s performance and assess what’s the best option for you.

What about charging infrastructure?

Depending on the type of electric vehicles you consider, the charging infrastructure you choose to implement will vary. It is unlikely that your drivers will be able to rely solely on public facilities for charging. However, there are various options you can consider, such as installing charge points at one office, across multiple sites, at drivers' homes, or a combination of these.

Regardless of the option you choose, there are a few points to consider:

You will likely not have to change your charge points when you replace your electric fleet. When calculating your Total Cost of Ownership (TCO), be clear about whether you have excluded, included, or spread the cost over a decade or more.

There are multiple incentives available across the EU and various countries to assist businesses with the cost of charging infrastructure. Make sure to research the different incentives that may apply to you. Additionally, charge point manufacturers and electrification partners may offer support in spreading upfront infrastructure costs.

The charging infrastructure you need will depend on the type of electric vehicles you choose to electrify your fleet. For example, if you switch to e-bikes, charging at drivers' homes would be easier. However, electric cargo bikes, e-mopeds, or e-vans would require more extensive charging infrastructure.

The cost impact of cargobikes

On average 51% of all motorised trips in European cities that involve the transport of goods could be shifted to bikes or cargo bikes. Cargo bikes do not only make sense from a business and environmental point of view, but also from a financial one.

Having considered all factors (including the associated health benefits of cycling with goods versus driving), JustEconomics established a fair value delivery metric for each type of vehicle. This ‘fair price’ for each delivery came in at £6.42 for diesel vans, £5.68 for EVs, and £4.98 for cargo bikes.

Additionally, it was calculated that per mile a diesel van averages 66 pence in cost versus 7.8 pence for the cargo bike!

In 2023, Cargo Revolution was estimated that local authorities in the UK could save £660 million just by switching to electric cargo bikes.

Summary

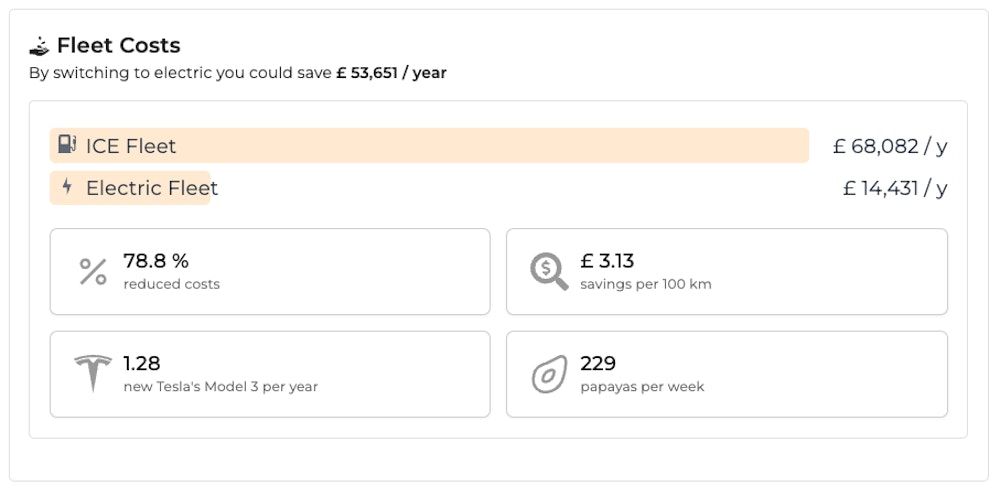

How to track your cost savings

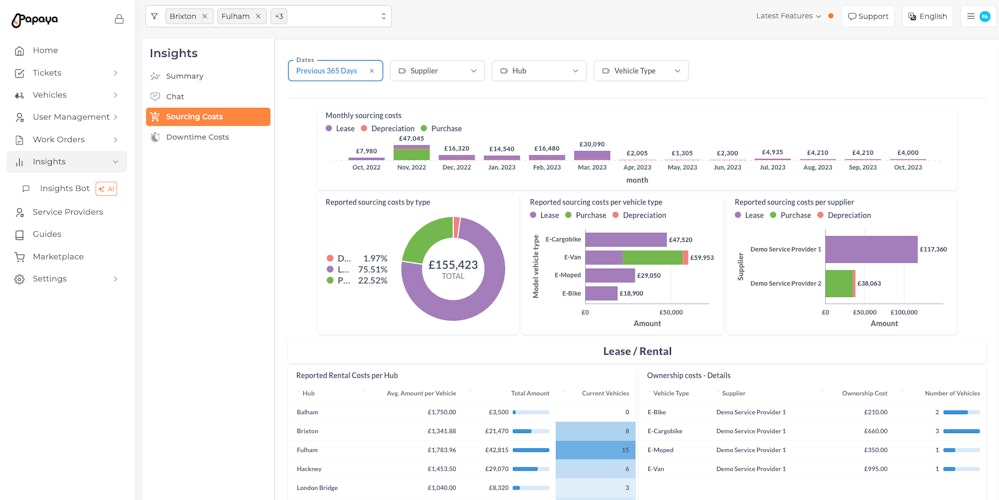

Overall, electric vehicles (EVs) are financially suitable for most fleets and may even save money for EU fleet managers. However, fleet managers will need to closely analyze their Total Cost of Ownership. To identify savings efficiently, Papaya has released a Carbon and cost calculator to assist EU fleet managers in simulating the potential savings they could achieve by transitioning their fleet to electric vehicles.

Additionally, Papaya's vehicle and fleet management software assists fleet managers in automatically tracking TCO (Total Cost of Ownership) over time. To learn more, reach out to our fleet electrification experts and discover how our software can help you effectively manage your fleet.